The Nasdaq and S&P 500 are formally in correction territory. Effectively, The Day by day Breakdown seems to be for the shares which might be rallying.

Friday’s TLDR

Not all shares are down this 12 months

A more in-depth take a look at gold

The Backside Line + Day by day Breakdown

We not too long ago talked about how diversification can assist shelter a portfolio from will increase in volatility. At the moment, 9 of the 11 S&P 500 sectors had been nonetheless optimistic on the 12 months, whereas gold was up about 10% and bonds had been optimistic on the 12 months.

In lots of circumstances, a diversified portfolio would nonetheless be down on the 12 months, however it could be higher than the ~10% pullback we’ve seen within the S&P 500.

Diversification is one instrument, relative energy is one other.

Seasoned buyers typically look towards relative energy to seek out the shares which might be performing properly relative to a selected benchmark. That benchmark could possibly be vs. their sector — like how Apple or Amazon are performing vs. the tech sector — or towards an index just like the S&P 500 and Nasdaq 100.

Discovering Relative Energy

The S&P 500 is down 10.1% from its report closing excessive, whereas the Nasdaq is down 13.3%. The indices are down 6.1% and eight.5% to date 12 months so far, respectively.

Notably, 9 of the 11 S&P 500 sectors are nonetheless outperforming the indices on a year-to-date foundation. When excluding tech and client discretionary — which account for roughly 40% of the S&P 500 weighting — the worst-performing sector is industrials, down simply 2.3% this 12 months.

Let’s dig into particular person shares.

I combed by way of the S&P 100 — the 100 largest US firms by market cap — to seek out shares which might be performing properly relative to the S&P 500. Right here’s what we discovered:

68 shares are outperforming the S&P 500 on a year-to-date foundation.

Additional, two-thirds of them (46) are literally optimistic to date this 12 months.

30 shares are outperforming the S&P 500 and Nasdaq 100 in the case of the drawdown from their 52-week excessive.

Impressively, all however one in every of them are literally optimistic on the 12 months too (besides MasterCard, which is down a paltry 0.2%).

Of the 30 shares from the second bullet level, the ten greatest performers to date this 12 months embody: Phillip Morris, Gilead Sciences, Amgen, AbbVie, Basic Electrical, 3M Co, T-Cellular, Abbott Labs, Medtronic, and AT&T.

The subsequent seven — IBM, Johnson & Johnson, Coca-Cola, Deere, RTX Corp, Altria and AIG — are all up not less than 10% this 12 months.

The Backside Line

I notice I threw loads of names on the market, however my level is fairly easy: Virtually half of the S&P 100 is definitely optimistic on the 12 months. That’s to not say this atmosphere has been simple, as lots of buyers’ favourite shares and sectors are beneath important stress.

Discover how not one mega-cap tech inventory within the group above. That’s to not shun tech; it’s been an awesome long-term performer. Nevertheless it pays to look outdoors of this group every now and then to seek out the shares which might be actually performing the very best.

Wish to obtain these insights straight to your inbox?

Join right here

The setup — Gold

The gold ETF — GLD — continues to chug greater. Shares are up greater than 13% to date this 12 months and have rallied greater than 37% over the previous 12 months.

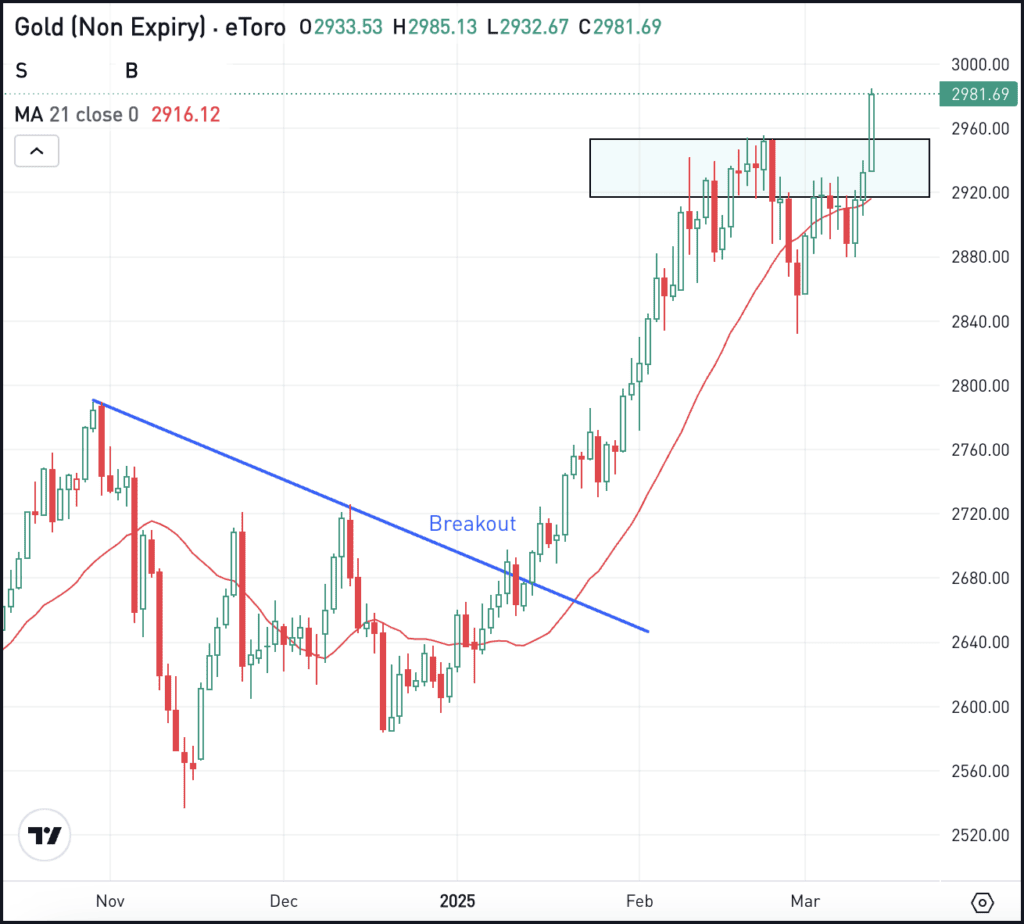

This simply outperforms the S&P 500, which is down greater than 6% to date this 12 months and is up simply 6.9% over the previous 12 months. Beneath is a take a look at bodily gold, which is nearing $3,000 an oz.:

Ideally, bulls will wish to see gold costs keep above the $2,920 to $2,950 zone. On the GLD, that roughly interprets about $270 to $272.

If gold strikes beneath these ranges, it’s not essentially the tip of the world, however it’s the place the pattern would begin to lose its short-term momentum. Over the long run although, it’s arduous to disclaim that this asset has carried out fairly properly.

Choices

For choices merchants, calls or name spreads could possibly be one strategy to commerce GLD on the lengthy aspect. In these eventualities, choices patrons restrict their threat to the worth paid for the calls or name spreads, whereas attempting to capitalize on a bounce within the inventory.

Conversely, buyers who anticipate draw back may speculate with places or put spreads.

To be taught extra about choices, think about visiting the eToro Academy.

Disclaimer:

Please word that as a consequence of market volatility, a number of the costs might have already been reached and eventualities performed out.