Be a part of Our Telegram channel to remain updated on breaking information protection

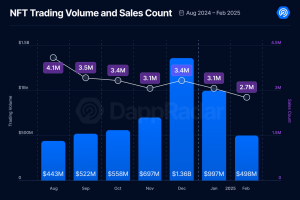

The once-booming marketplace for non-fungible token collections is experiencing one other meltdown. For one more month, the NFT market has plummeted when it comes to buying and selling gross sales quantity and flooring value values. Previously month, the NFT market has raised a buying and selling gross sales quantity of $498 million, down 50% from the earlier month. On this article, we will discover some components fueling this downturn.

3/ NFT buying and selling quantity plummeted 50% to $498 million, mirroring the broader crypto downturn, whereas AI-driven and sports activities NFT collections gained momentum. pic.twitter.com/KkVnubJ0Vu

— DappRadar (@DappRadar) March 6, 2025

NFT Gross sales Fall +50% In February 2025

A report compiled by DappRadar, a crypto market knowledge aggregator and multi-chain non-fungible token assortment platform permitting customers to commerce the whole lot from DeFi to NFTs and gaming, reveals that the NFT market has recorded unfavourable development once more in February. Based mostly on the report, the NFT market has amassed a buying and selling gross sales quantity of $498 million, down +50% from the earlier month.

The worldwide NFT market downturn got here alongside an enormous fall in cryptocurrency costs, reflecting a broader market development. The NFT market retested some surge in This autumn 2024, reaching a document excessive of $1.36 billion in December 2024. Sadly, the NFT development momentum has slowed for the reason that begin of the yr, with buying and selling gross sales lowering to $997 million in January 2025. The correlation between crypto costs and NFT valuations has since remained sturdy, driving gentle fluctuations in buying and selling exercise.

In February 2025, the profile image (PFP) non-fungible token assortment led in buying and selling quantity, producing $243 million throughout 76,385 gross sales, with 99% of transactions occurring on the Ethereum blockchain community. Throughout this time, gaming NFTs secured the second-highest buying and selling quantity at $41 million, with 421,853 property traded, totally on the Immutable X blockchain community. Sports activities NFTs dominated the third highest quantity, accounting for $7.7 million in gross sales quantity, with 98% of exercise taking place on Starkware.

Penguins & Doodles Defy The NFT Bear Market

Regardless of the downturn, the Pudgy Penguins remained some of the energetic NFT collections within the NFT market. Launched in 2021, Pudgy Penguins is a non-fungible token assortment that includes a restricted version of 8,888 NFTs hosted on the Ethereum blockchain community. Regardless of declining buying and selling quantity, the Pudgy Penguins NFT buying and selling gross sales elevated by 25%, indicating sturdy buying and selling exercise at cheaper price factors.

Doodles, a non-fungible token assortment that includes a restricted version of 10,000 NFTs hosted on Ethereum, is one other NFT assortment that has defied the bear. In February, Doodles noticed a notable surge in quantity, pushed by its announcement of a brand new token, DOOD, set to launch on Solana. This strategic transfer is a part of the undertaking’s broader effort to broaden its ecosystem and supply further worth to its neighborhood, producing contemporary pleasure across the assortment.

Based mostly on the DappRadar report, Kaito Genesis is one other NFT assortment that has defied the NFT bear market. Launched in December 2024, Kaito Genesis, an AI-driven NFT assortment by Kaito AI, a famend digital asset search engine designed to democratize crypto and NFT data, consisting of a restricted set of 1,500 distinctive NFTs on the Ethereum blockchain community. In February, Kaito Genesis noticed its NFT flooring value attain an all-time excessive of seven.65 ETH.

Courtyard, an progressive non-fungible token undertaking that bridges bodily collectibles and digital property, is one other NFT assortment that surged in February. Developed by Courtyard.io, the NFT platform permits collectors to tokenize real-world objects similar to graded buying and selling playing cards by storing them in Brink’s-operated vaults and minting them as NFTs on the Polygon community. This fusion of tangible and digital property reveals a novel evolution within the NFT area, catering to conventional customers and web3 lovers.

Past the broader AI and PFP dominating Web3 in February, the NFT sector has additionally seen a rising curiosity in sports activities digital property. Regardless of having a brand new rival, “CricSage,” Sorare, a long-standing chief in sports-based NFTs, continued to dominate. CricSage is a brand new NFT gaming platform providing a cricket-based opinion buying and selling platform the place customers should buy and promote “Sure” or “No” NFTs based mostly on real-world cricket occasions.

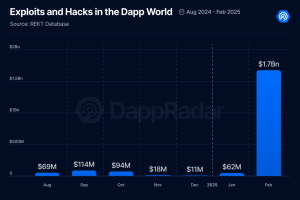

Crypto Hacks On The Rise In 2025

February entered information as essentially the most devastating month within the quick crypto and non-fungible token historical past. Within the final week of February, Bybit, an NFT and crypto trade platform, suffered the biggest hack, leaving over $1.5 million stolen. This staggering determine marks the biggest quantity ever misplaced in a month resulting from hacking incidents. The North Korean hacker group Lazarus was discovered liable for the Bybit hack.

Associated NFT Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection