Please see this week’s market overview from eToro’s international analyst crew, which incorporates the newest market information and the home funding view.

Huge Tech Q3 earnings, the October jobs report and US elections inside 8 days

It’s a pivotal week for markets. 5 of the “Magnificent 7” firms are set to report earnings, alongside contemporary macroeconomic information on development, inflation, and the October jobs report.

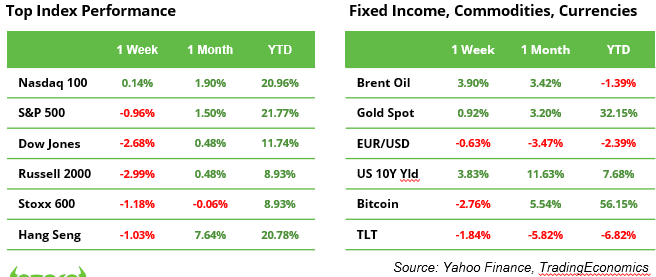

Final week’s blended outcomes make this week a possible “make-or-break” second: the Nasdaq gained 0.2%, the S&P 500 declined by 1%, and the Dow Jones dropped 2.7%. The Nasdaq was bolstered by Tesla’s better-than-expected outcomes, whereas the Dow Jones suffered from a bond sell-off that reshaped the Fed’s rate-cut expectations and was additional impacted by disappointing earnings from GE Aerospace, 3M, Honeywell, and Boeing.

If Huge Tech misses expectations and the job market exhibits weak spot, fears of slower financial development may resurface—only one week forward of the U.S. presidential election on November 5.

The Huge 5 that can report symbolize 23% of the S&P 500 Index

This week within the US earnings season, tech is within the highlight. 5 giants, Alphabet, Amazon, Apple, Meta, and Microsoft, are set to launch their quarterly outcomes from Tuesday to Thursday. With out Huge Tech, the S&P 500 may battle, with the “Magnificent 7” forecasted to put up 18.1% year-over-year earnings development in comparison with 3.4% for the general S&P 500.

Since summer time lows, Huge Tech shares have proven blended efficiency. Meta leads with a 30% rise, doubling the S&P 500’s 14% enhance, and is the one inventory among the many 5 to hit a brand new all-time excessive. Amazon and Apple additionally outperform the broader market, whereas Google and Microsoft lag. Latest sell-offs have created enticing entry factors as traders keep religion in Huge Tech.

Investor focus will probably be on whether or not outcomes meet expectations. Large AI investments are reshaping tech, with prices, expenditures, and potential delays in each current and new tasks being high issues. Key questions embody how rapidly AI may be monetized and particular points distinctive to every firm.

Within the cloud sector, Amazon and Microsoft are in a development race with AWS and Azure. For Apple, iPhone gross sales stay essential, making up almost half of its income, with Apple Intelligence launching October 28 for U.S. English customers. The AI methods of Meta AI and Google’s Gemini, Meta and Alphabet’s advert income, and Amazon’s e-commerce gross sales will present key insights into shopper behaviour.

The subsequent take a look at for the bond market

The US bond market faces a essential two-week interval that can doubtless set its course for the remainder of the 12 months. Key occasions kick off with the Treasury’s announcement on upcoming debt gross sales and month-to-month payroll information, which can point out if the financial system is slowing sufficient to justify additional Fed charge cuts. Subsequent week, consideration will shift to the November 5 presidential election and the Fed’s assembly shortly after.

Treasury costs have been hit by a pointy sell-off as financial resilience casts doubt on deeper charge cuts. If Donald Trump wins the presidency, bond yields could rise as markets anticipate inflation from potential tax cuts and tariffs. Merchants are additionally in search of safety in opposition to yield spikes, paying excessive premiums on choices.

Amidst market turbulence, the Fed’s most well-liked inflation measure and job openings information are anticipated to replicate easing value pressures, and U.S. payroll development is anticipated to sluggish. Company earnings and Chinese language coverage choices may additional affect volatility. The Fed’s upcoming determination, coupled with the election end result, has traders speculating closely on yields, particularly if Trump’s insurance policies take impact and gas the deficit.

Earnings and occasions

Macro-economic releases:

30 Oct. GDP Q3 for US and Eurozone

31 Oct. US PCE (Private Consumption Expenditure), the Fed’s favorite inflation gauge

1 Nov. US NFP (Non-Farm Payrolls) and October unemployment charge (beforehand 4.1%)

Earnings releases:

28 Oct. Ford

29 Oct. PayPal, McDonalds, Pfizer, HSBC, BP (earlier than US market open)

29 Oct. Alphabet, Visa, AMD, First Photo voltaic, Reddit (after US market shut)

30 Oct. Eli Lilly, Caterpillar, BYD, Volkswagen, BASF, Schneider Electrical, Banco Santander

30 Oct. Microsoft, Meta, Reserving, Starbucks, DoorDash, Coinbase, Robinhood

31 Oct. Uber, Mastercard, Shell, BNP Paribas, Stellantis

31 Oct. Apple, Amazon, Intel, US Metal

1 Nov. Exxon Mobil, Chevron

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.