Bitcoin remains to be holding above the $94,000 degree, displaying clear indicators of energy after months of promoting stress and prolonged consolidation. Bulls have regained short-term management, pushing costs greater as optimism grows throughout the market. Nonetheless, the setting stays removed from risk-free, with volatility nonetheless elevated and macroeconomic circumstances shifting quickly amid ongoing international commerce tensions.

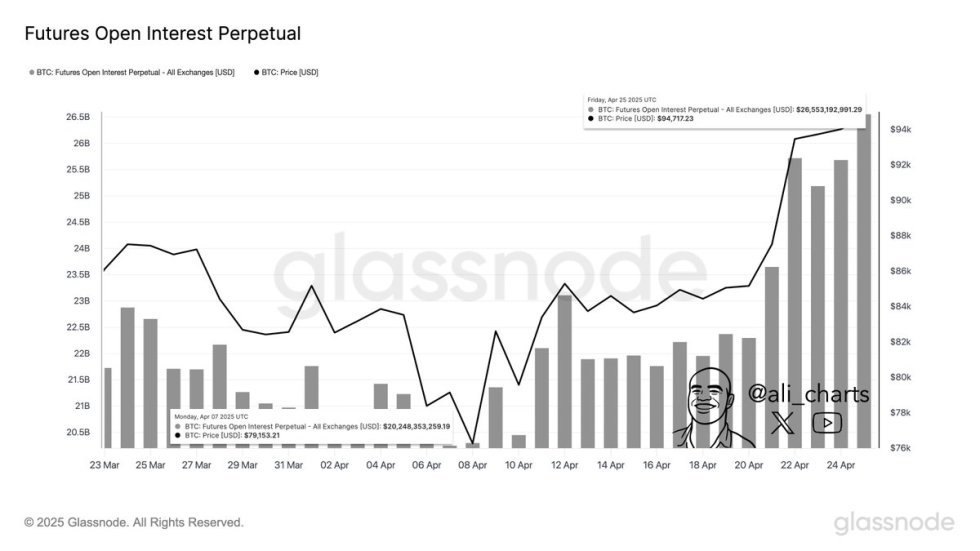

In line with current information from Glassnode, Bitcoin open curiosity has jumped 20% over the previous 20 days. This surge means that merchants are more and more positioning for continued upside, but it surely additionally signifies that leverage is constructing throughout the market, which might amplify future value swings.

As Bitcoin checks the higher finish of its current buying and selling vary, the approaching days can be essential. A profitable push towards the $100K mark might set the stage for a contemporary rally into uncharted territory, whereas failure to carry help would expose BTC to a different spherical of consolidation or correction.

Bitcoin Exams Important Ranges As Volatility Rises

Bitcoin has been on a wild journey since November 2024, when Donald Trump received the US Presidential election and international markets reacted with heightened volatility. Macroeconomic tensions, commerce conflicts, and unstable monetary circumstances have created an unpredictable setting, and Bitcoin has been no exception. Nonetheless, regardless of the turbulence, bulls have lately regained short-term management.

After pushing decisively above the $89,000 resistance, a key degree that had capped Bitcoin’s upside for weeks, BTC is now testing essential zones just under the $100,000 mark. This degree represents a psychological barrier for the market and a possible gateway to new all-time highs if bulls handle to interrupt via with energy.

High analyst Ali Martinez shared insights on X, revealing that Bitcoin open curiosity has jumped 20% over the previous 20 days, now topping $26 billion. This important improve reveals that merchants are aggressively positioning for future value actions. Nonetheless, it additionally highlights rising leverage throughout the market, which may enlarge each beneficial properties and losses within the quick time period.

Leverage-driven rallies are typically fragile, so whereas sentiment has shifted bullishly, dangers stay excessive. The approaching weeks can be essential for Bitcoin because it both confirms this breakout or faces one other spherical of intense volatility.

BTC Weekly Shut: Bulls Should Defend $90K

Bitcoin is buying and selling round $94,000 because the market approaches a vital weekly shut. After weeks of intense volatility and heavy promoting stress earlier this 12 months, bulls have lastly regained management. Nonetheless, with international macroeconomic circumstances nonetheless extremely unstable, particularly attributable to ongoing US-China commerce tensions, warning stays needed.

For Bitcoin to keep up its bullish momentum, bulls should safe a weekly shut above the $90,000 mark. This degree now acts as a crucial help zone, and shutting above it will reinforce the concept that Bitcoin is constructing energy for a possible push towards new highs.

Nonetheless, reclaiming the $100,000 degree rapidly is significant. A transfer above $100K wouldn’t solely mark a significant psychological breakthrough but additionally set the stage for a powerful rally into uncharted territory. If Bitcoin stalls too lengthy beneath $100K, uncertainty and rising market dangers might invite renewed promoting stress.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.