Knowledge exhibits the Bitcoin Open Curiosity has seen a surge to a brand new all-time excessive (ATH) just lately, an indication that volatility could possibly be brewing for BTC.

Bitcoin Open Curiosity Has Been Going Up Not too long ago

As identified by CryptoQuant founder and CEO Ki Younger Ju in a brand new publish on X, the Bitcoin Open Curiosity has simply set a brand new report. The “Open Curiosity” right here refers to an indicator that retains monitor of the full quantity of BTC-related derivatives positions which might be open on all centralized exchanges.

Beneath is the chart shared by Younger Ju that exhibits the development on this metric over the previous few years:

The worth of the metric seems to have been heading up in latest days | Supply: @ki_young_ju on X

As is seen within the graph, the Bitcoin Open Curiosity has been on the rise just lately, which means that the traders have been opening contemporary positions available on the market. Following the newest continuation of the rise, the indicator has hit a worth of $20 billion, which is a brand new report. As for what this excessive might imply for the cryptocurrency’s value, a excessive Open Curiosity is usually adopted by sharp volatility within the asset.

On paper, this volatility can take the coin in both route, however from the graph, it’s obvious that peaks within the indicator have, in actual fact, often led to tops for the cryptocurrency.

The supply of the volatility is often mass liquidation occasions, which will be possible to happen when the market has a considerable amount of positions with excessive leverage concerned.

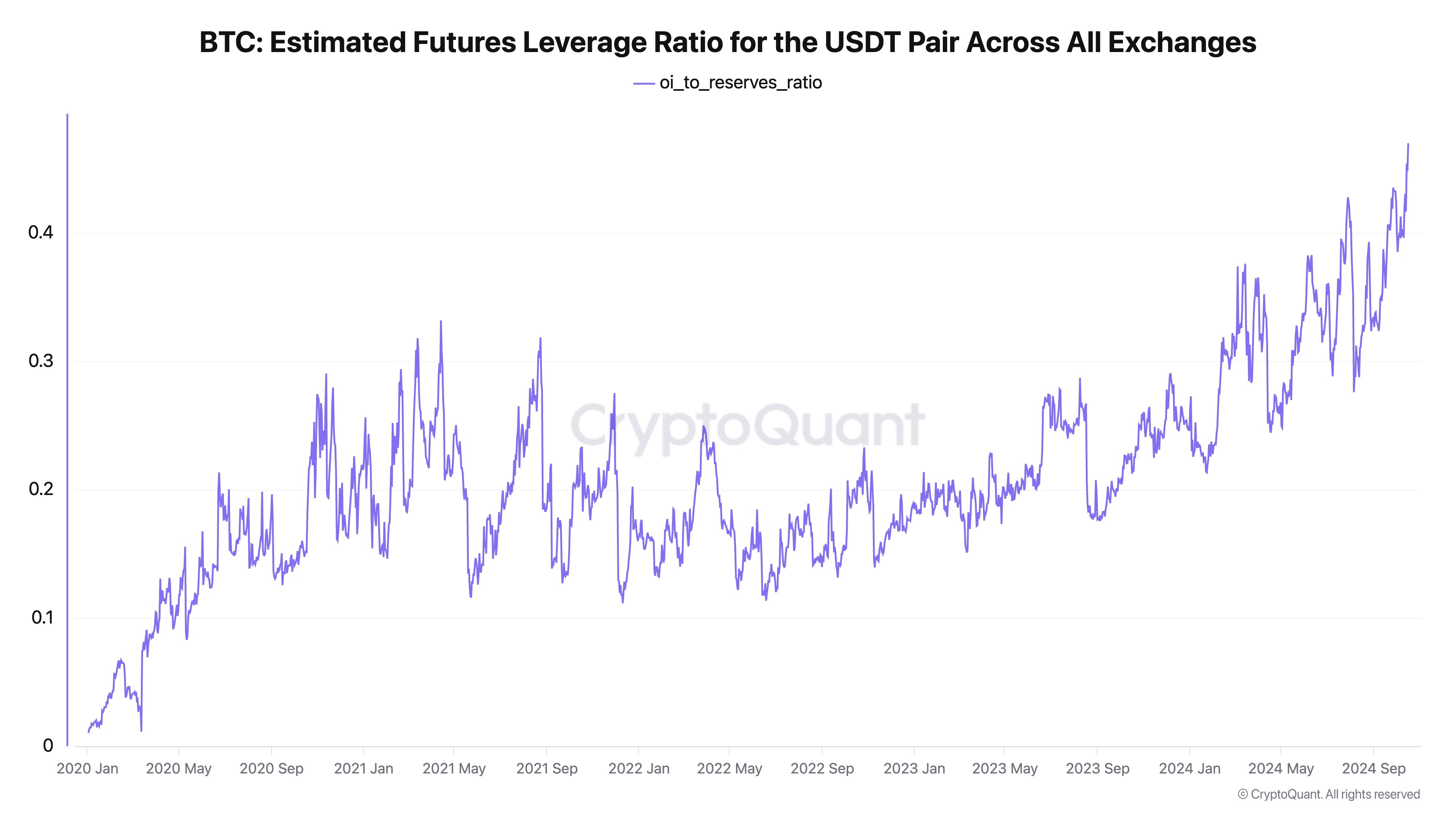

In one other X publish, the CryptoQuant CEO shared the info for the Bitcoin Estimated Leverage Ratio, which principally tells us in regards to the common quantity of leverage that customers are presently choosing.

Seems to be like the worth of this metric has additionally been rising just lately | Supply: @ki_young_ju on X

The Estimated Leverage Ratio is calculated because the ratio between the Open Curiosity and the full change reserve of the underlying asset. Within the present case, Younger Ju has posted the model of the indicator that tracks the positions which have Tether’s stablecoin, USDT, because the collateral.

Whereas this actually doesn’t cowl all the market, this model of the metric can nonetheless present us with a touch of the final development being adopted by merchants as a complete.

As displayed within the above graph, the Bitcoin Estimated Leverage Ratio for the USDT pair has shot up just lately, which means the traders have elevated their urge for food for threat.

Thus, with all this leverage concerned, BTC might really be vulnerable to seeing a risky explosion. Contemplating that these new positions which have been popping up could possibly be lengthy positions, the merchants betting on a bullish final result could as soon as once more be those to get caught up within the volatility.

BTC Worth

Bitcoin had crossed above the $68,000 stage yesterday, however the asset seems to have seen a pullback since then because it’s now all the way down to $67,200.

The value of the coin seems to have been driving an uptrend over the previous few days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com