Bitcoin has skilled a pointy pullback because the crypto market reacted to rising political tensions between Elon Musk and U.S. President Donald Trump. The surprising conflict started when Musk brazenly criticized the administration’s proposed “Massive Lovely Invoice” on X, calling it damaging to innovation and digital freedom. In response, Trump fired again with feedback that fueled hypothesis and uncertainty throughout monetary markets. This sudden confrontation between two of probably the most influential voices in finance and tech rapidly spilled into the crypto area.

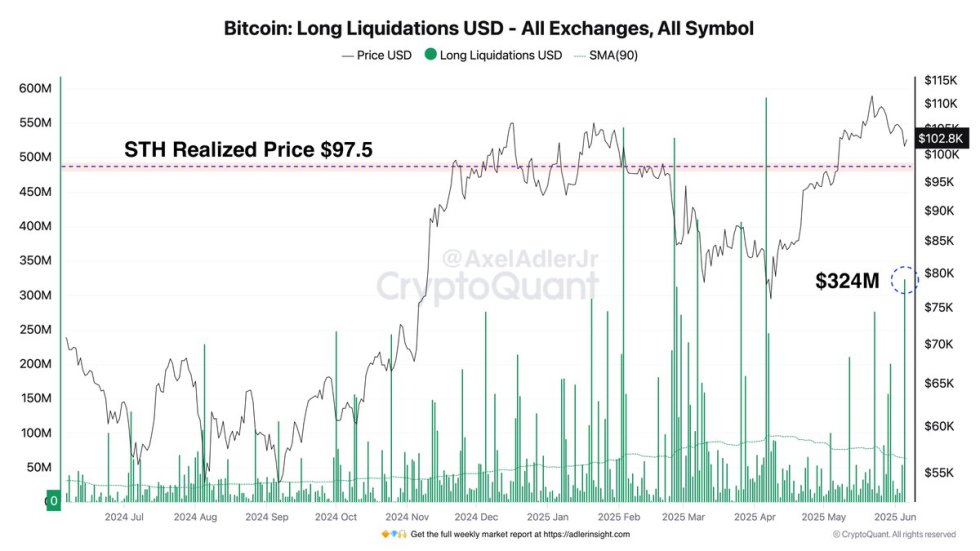

Inside hours of the trade, Bitcoin dropped over 5%, breaking under short-term help ranges and sparking volatility throughout main altcoins. In line with CryptoQuant knowledge, the futures market reacted violently, with over $324 million in lengthy positions liquidated in a single session, marking one of many largest liquidation occasions in 2025. Merchants have been caught off guard as directional sentiment flipped quickly, reflecting rising unease.

Now, the market faces elevated short-term threat as contributors digest the political fallout and its potential implications for regulation, taxation, and broader financial sentiment. Whereas Bitcoin stays above the $100K mark, confidence has taken successful, and the approaching days could decide whether or not this was a brief shakeout or the beginning of a deeper correction.

Political Tensions Spark Volatility And Liquidations

Bitcoin stands at a pivotal second because it hovers under its all-time excessive of $112,000. The broader market is watching carefully, anticipating both a breakout into worth discovery or a deeper retracement if momentum fades. Bulls keep management above the $100,000 stage, however the latest surge in volatility has highlighted rising dangers. Macroeconomic headwinds—notably rising US Treasury yields and international uncertainty—have saved markets on edge. Now, political friction is including gas to the fireplace.

The newest supply of instability got here from an explosive conflict between Elon Musk and US President Donald Trump. Their public disagreement over the controversial “Massive Lovely Invoice,” criticized by Musk on X, spooked buyers throughout the board. In line with prime analyst Axel Adler, this battle triggered one of many sharpest reactions within the crypto derivatives market this 12 months. Bitcoin futures noticed over $324 million in long-position liquidations inside hours, marking a major shift in short-term sentiment.

If Bitcoin fails to reclaim momentum above the $110K area, merchants could start eyeing draw back targets. Adler factors to $97,500 as the closest help stage, aligning with the Brief-Time period Holder (STH) Realized Value. A drop under that stage might speed up the decline and shift momentum in favor of bears. Nevertheless, if BTC holds its present floor and sentiment recovers, the foundations stay intact for a robust continuation into new highs.

Bitcoin Holds Key Help As Bulls Defend $103,600 Stage

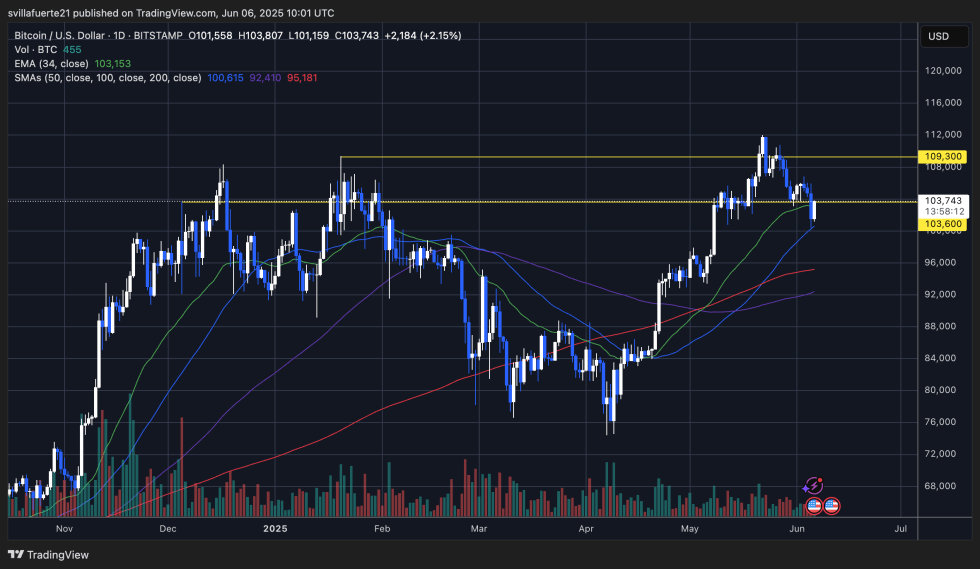

Bitcoin is exhibiting resilience after a pointy retrace from the $112K all-time excessive, bouncing off the $103,600 help stage, marked by robust historic relevance and alignment with the 34-day EMA. As seen within the chart, BTC tapped this zone with a low of $101,159 earlier than rapidly reclaiming increased floor, at present buying and selling close to $103,743.

The bounce has fashioned a possible increased low inside the broader uptrend, signaling that bulls should not but giving up management. Nevertheless, the failed breakout above $109,300 highlights resistance strain, and BTC must decisively flip that stage into help to verify a bullish continuation.

Quantity on the newest candle suggests consumers are stepping in, however the lack of a robust surge signifies market warning. The 50-day SMA (inexperienced) stays upward sloping, providing medium-term help, whereas the 100-day and 200-day SMAs are nonetheless trending under, reinforcing the bullish bias until the worth drops under $100K.

For now, $103,600 is the extent to observe. A breakdown under that might open the door to additional declines towards the $98K-$100K vary. A sustained push above $106K, alternatively, would seemingly invite bullish momentum and retest the $109K barrier.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.