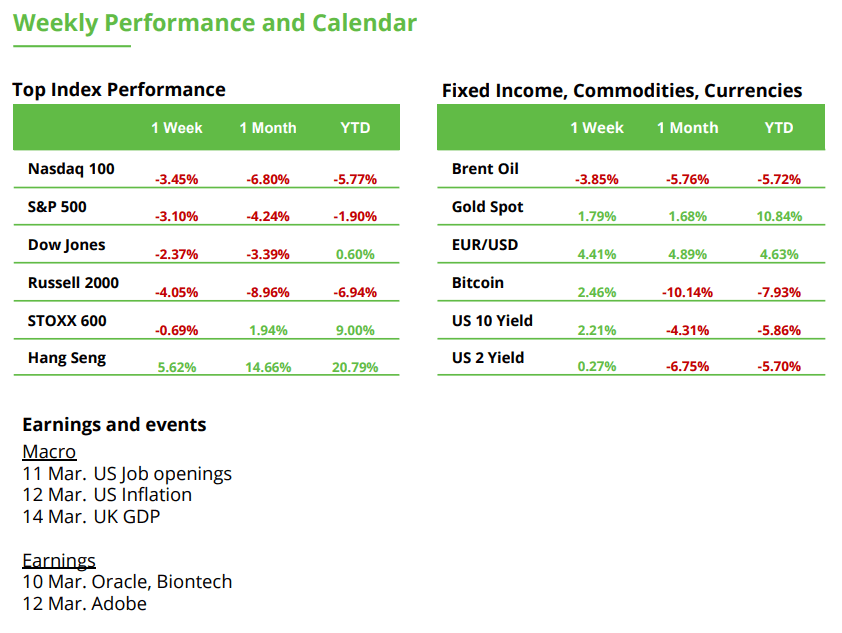

Simply when buyers thought that they had readability, they acquired chaos. President Trump slapped 25% tariffs on imports from Canada and Mexico, sending markets right into a tailspin. By March 6, the White Home threw in a last-minute exemption for USMCA-compliant items, bringing transient reduction, however wait, there’s extra! A 30-day delay on auto tariffs added one other layer of confusion.

Why does this matter? Markets hate uncertainty. When tariffs flip-flop, companies pause investments, retailers warn of worth hikes, and sectors like tech and autos get hammered. Finest Purchase ($BBY) and different client giants are already flagging increased prices and stagflation fears.

The Fed: “WE’RE IN NO RUSH” Fed Chair Powell didn’t sugarcoat it- price cuts aren’t coming anytime quickly. With inflation nonetheless hovering above 2%, the Fed is in wait-and-see mode. The US economic system added 151K jobs in February (higher than final month, however nonetheless meh), giving Powell sufficient purpose to pump the brakes on easing. In the meantime, throughout the pond… The ECB lower charges, however Lagarde cautioned that rising vitality costs from geopolitical tensions may shift coverage. Investor takeaway: Charge cuts aren’t a given. Development shares (particularly tech) may see extra volatility, whereas financials and dividend-paying performs may maintain regular.

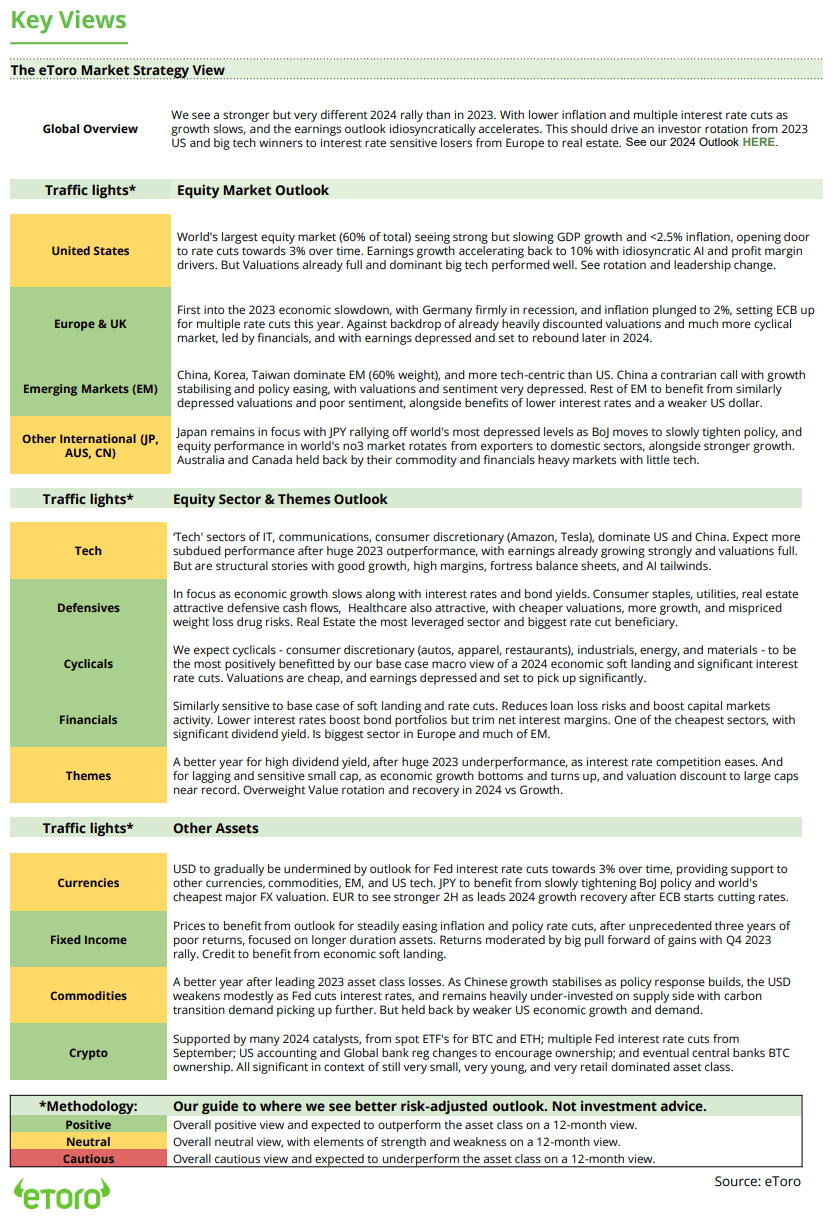

How Traders Are Taking part in 2025: With markets swinging like a pendulum, buyers are tweaking their playbook: diversifying, hedging, and attempting to find stability.

Core methods: Traders are hedging single-stock danger with broad market publicity by means of diversified ETFs.

Worldwide Equities ($VEU): With world markets displaying pockets of resilience, buyers are dipping into European and Asian shares for diversification.

High quality over Hype: Traders deal with high-quality ($QUAL) corporations with stable fundamentals as a substitute of chasing meme shares.

Sector Themes: Who’s Successful & Shedding?

Defensive Sectors on the Rise: Healthcare ($XLV), utilities ($XLU), and client staples ($XLP) are attracting inflows as buyers search stability.

Financials Discover Their Footing: Extra Than Only a Bounce? Monetary shares ($XLF, $VFH) have proven notable resilience amid latest market turmoil. Banks ($KBE) and worth shares outperformed, supported by rising internet curiosity margins and bettering mortgage progress.

Thematic Investing: Cash is shifting towards long-term progress themes like: 1. Protection shares, world army spending is skyrocketing, led by Europe. 2. Clear vitality ($ICLN), authorities subsidies preserving momentum alive.

Hedging: How good cash is defending itself

Gold ($GLD) & Commodities ETFs: A basic inflation hedge as price lower expectations stay murky.

Bond ETFs ($TLT) for Revenue: With the US 10-year yield at ~4.3%, some buyers are locking in yields earlier than central banks pivot. In addition they generate common revenue and assist stabilize returns throughout inventory market turbulence.

Crypto Allocation: In unstable occasions, it’s sensible to stay with the crypto blue-chips. Bitcoin ($BTC) and Ethereum ($ETH) stay the go-to holdings for a lot of buyers. Why? They’ve the largest networks, essentially the most adoption, and severe institutional backing.

Bottomline: For years, tech was the undisputed king. However 2025 may be different- as a substitute of simply AI shares carrying the market, we’re seeing a extra balanced efficiency throughout a number of sectors. Traders are adjusting accordingly: favoring high quality & stability over hypothesis.

Europe’s New Funding Technique Boosts the Euro

The Market Is Repricing the Euro: EUR/USD ($EURUSD) surged final week, rising from beneath 1.04 to over 1.08, a 4.4% acquire and the strongest weekly improve in years. The euro reached its highest stage since November, signaling a possible elementary shift. Europe is now focusing extra on a brand new funding technique to stimulate progress, offering extra assist for the euro. Not way back, there have been fears that the pair would drop again to parity because of the “Trump Commerce”. These considerations now appear to have pale.

Fiscal Coverage Shift: EU Fee President von der Leyen plans to mobilize as much as €800 billion to strengthen Europe’s protection capabilities and preserve assist for Ukraine. On the similar time, the CDU and SPD, at the moment in coalition negotiations for the brand new German authorities, have agreed on a €500 billion particular fund for infrastructure modernization. Moreover, the debt brake is about to be relaxed for focused protection spending.

Bond Market Turmoil: The ten-year German bond yield (see chart) surged from 2.39% to 2.85% final week – the sharpest improve in years. Traders are demanding increased yields as a danger premium for rising authorities debt. Nonetheless, increased yields additionally imply elevated borrowing prices, as long-term market rates of interest are carefully tied to 10-year bonds.

A Lot of Optimism Is Already Priced In: The shares of European protection corporations corresponding to Rheinmetall, BAE Techniques, Safran, Thales, Dassault Aviation, Kongsberg, and Saab AB share one frequent trait: in keeping with the RSI indicator, they’re short-term overbought – some greater than others. This market overheating displays excessive expectations for elevated protection spending. Whereas valuations seem stretched within the quick time period, the general progress development stays intact, making tactical timing more and more essential.

Bottomline: At this level, we stay cautiously optimistic in regards to the protection sector, supported by huge investments within the coming years. The important thing query will likely be how funds are allotted and which corporations are finest positioned to profit. Whereas Europe goals for better army independence from the US, a portion of the funds will nonetheless movement to American protection corporations. Raytheon Applied sciences, Honeywell, and Lockheed Martin ought to subsequently even be on the watchlist.

10-year German bond yield

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.