On-chain knowledge exhibits the Bitcoin Lively Addresses have continued to see a steep decline just lately, an indication that could possibly be bearish for BTC.

Bitcoin Lively Addresses Have Lately Seen Their Greatest Drop Since 2021

As identified by an analyst in a CryptoQuant Quicktake submit, the BTC Lively Addresses have been seeing a decline since March of this yr. An deal with is claimed to be “lively” when it participates in some form of transaction exercise on the community, whether or not as a sender or receiver.

The Lively Addresses indicator retains monitor of the distinctive whole variety of such addresses which are making transfers on the Bitcoin blockchain day by day. The distinctive lively addresses could also be thought-about the identical because the distinctive customers visiting the community, so the metric basically tells us about BTC’s each day site visitors.

Now, here’s a chart that exhibits the pattern within the 100-day Easy Transferring Common (SMA) of the Bitcoin Lively Addresses over the previous few years:

The worth of the metric seems to have been happening in latest months | Supply: CryptoQuant

As displayed within the above graph, the 100-day SMA of the Bitcoin Lively Addresses had been rising throughout 2023 and the early components of this yr, however since March, the metric has seen a pointy turnaround, with its worth now quickly happening as a substitute. The reversal occurred across the time of BTC’s new all-time excessive (ATH), so it’s doubtless that the indicator’s reducing is occurring as a result of consolidation that the coin has since been caught in.

Buyers discover sharp worth motion like rallies to be thrilling, whereas sideways motion to be boring, so the Lively Addresses registering a downturn in a interval like now isn’t too odd. What could also be price noting, although, is the dimensions of the drop that the 100-day SMA of the metric has noticed. Its worth is already beneath the bottom level noticed within the 2022 bear market and will quickly fall beneath the 2021 low as nicely.

Bitcoin usually requires an lively userbase to maintain any rally going, so the indicator’s worth witnessing a collapse just lately could possibly be a bearish signal. “You shouldn’t be stunned if BTC’s worth begins catching up with deal with exercise pattern very quickly,” notes the quant.

Whereas the Lively Addresses pattern has been trying destructive, CryptoQuant CEO Ki Younger Ju has stated in an X submit that Bitcoin continues to be in the course of the bull cycle.

Seems to be like the worth of the metric has been constructive in latest days | Supply: @ki_young_ju on X

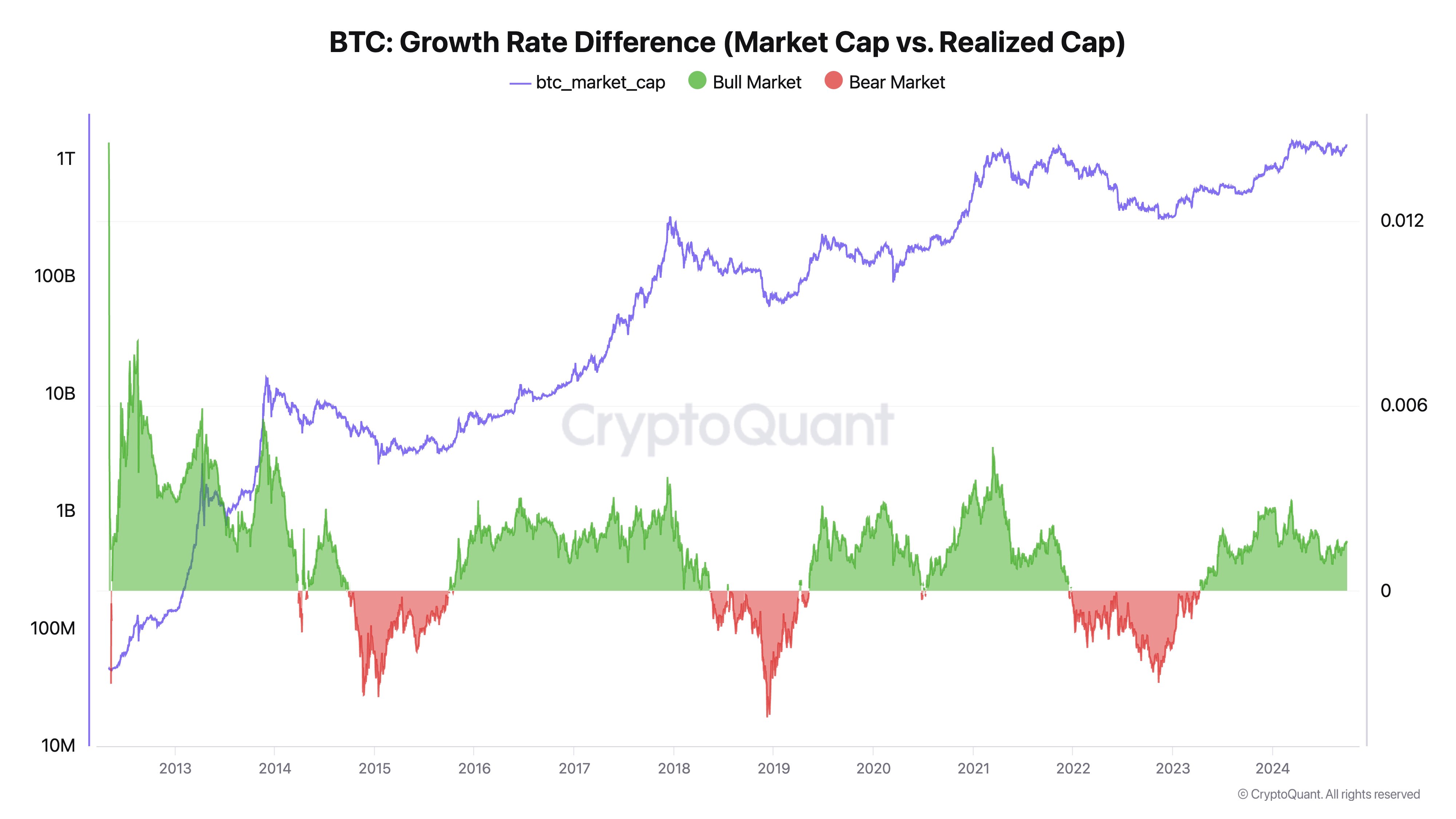

The above chart shared by Younger Ju exhibits the pattern within the Bitcoin Development Price Distinction, which is an indicator that compares the growths of the BTC market cap and realized cap.

The latter of those, the realized cap, is an on-chain capitalization mannequin that mainly tells us in regards to the quantity of capital that the buyers as an entire have put into the cryptocurrency.

At current, the indicator is inexperienced, that means the market cap is rising sooner than the realized cap. “When market cap grows sooner than realized cap, it could sign a bull market; the reverse might point out a bear market,” explains the CryptoQuant CEO.

BTC Worth

Bitcoin has seen a continuation of its newest plunge throughout the previous day as its worth has now slipped to the $62,700 stage.

The worth of the coin has seen a steep decline during the last couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com