Bitcoin (BTC) skilled a light sell-off yesterday, hitting a every day low of $100,372 on Binance crypto trade. Nevertheless, latest on-chain knowledge suggests the value hunch might persist, as BTC miners proceed transferring cash to exchanges at unprecedented ranges.

Bitcoin Miners-To-Alternate Transfers Hit File Excessive

In accordance with a latest CryptoQuant Quicktake put up by contributor CryptoOnchain, the entire realized influx from Bitcoin miners to exchanges has surged to historic highs. This spike doubtless contributed to the latest worth tumble from the mid-$100,000 vary.

For the uninitiated, Bitcoin miners’ complete realized influx to exchanges measures the precise quantity of BTC that miners have transferred from their wallets to cryptocurrency exchanges. A pointy rise on this metric sometimes indicators that miners are promoting extra of their holdings, which may enhance provide out there and probably drive costs down.

CryptoOnchain shared the next chart exhibiting miners’ inflows surpassing $1 billion per day between Could 19 and Could 28, 2025. If this pattern continues, BTC might face a deeper correction, probably falling into the low $90,000 vary.

An identical pattern was noticed earlier this 12 months in January when BTC was within the midst of a historic rally, creating a number of new all-time highs (ATH) in fast succession. On the time, BTC miners offloaded near 140,000 cash for roughly $13.72 billion.

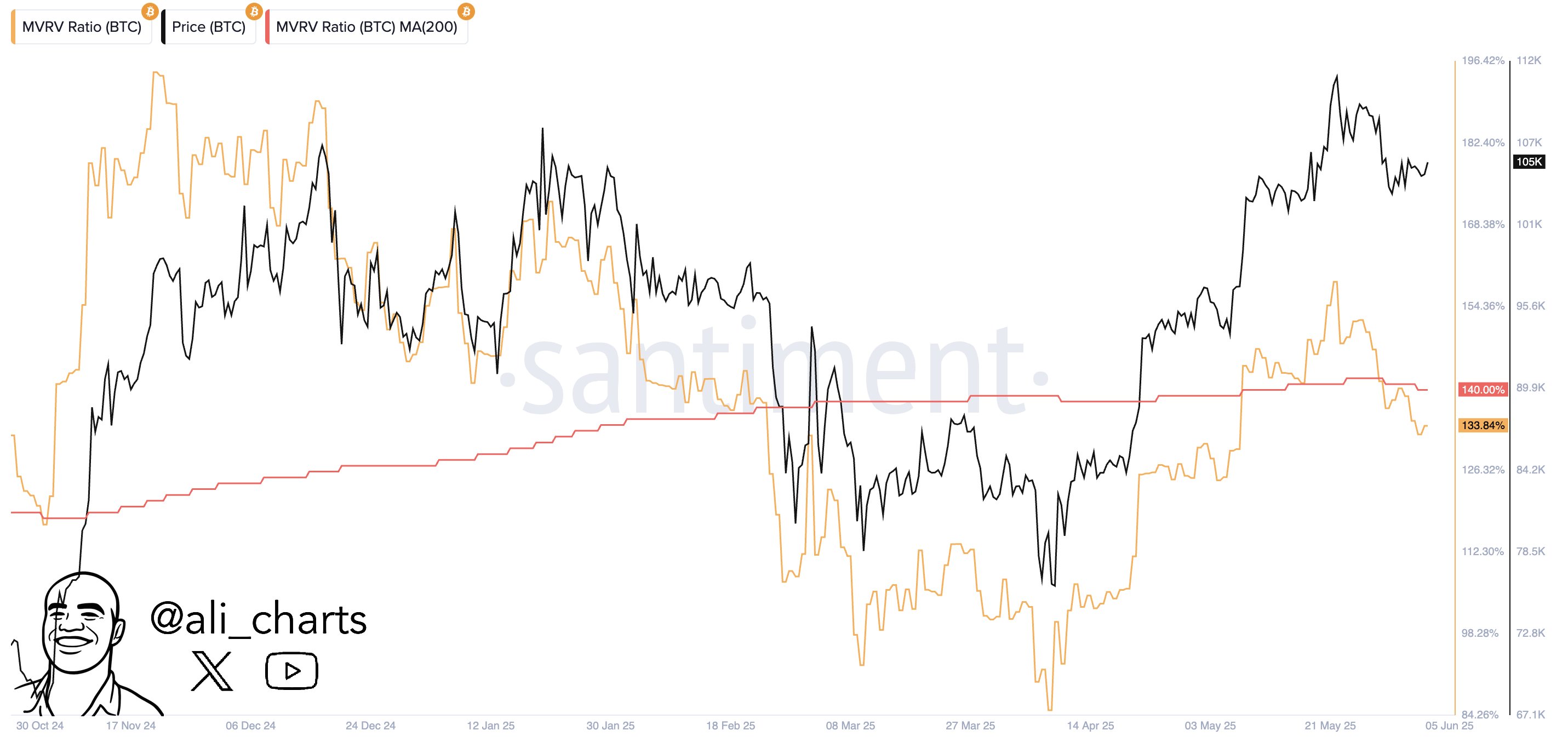

In the meantime, seasoned crypto analyst Ali Martinez identified one other bearish sign. In an X put up, he famous that the Bitcoin Market Worth to Realized Worth (MVRV) ratio has fallen beneath its 200-day easy shifting common (SMA) – an indication which will result in additional promoting stress.

When the MVRV ratio falls beneath its 200-day SMA, it means that the common market participant is holding Bitcoin at a loss or close to break-even. This usually signifies bearish sentiment or undervaluation, which may set off additional promoting amongst small traders.

BTC Holders Cautiously Optimistic

Including to the rising uncertainty, yesterday’s public feud between US President Donald Trump and Elon Musk additional dampened market sentiment. Some analysts now predict BTC might fall as little as $96,000.

Fellow crypto analyst Anup Ziddi made an analogous bearish forecast. The analyst not too long ago acknowledged that so long as BTC stays beneath $107,000, its possibilities of additional crashes will stay elevated.

That mentioned, there are nonetheless causes for cautious optimism. Latest on-chain knowledge reveals that new Bitcoin whales are aggressively accumulating the asset, reinforcing the potential for a future provide squeeze. At press time, BTC is buying and selling at $104,963, up 0.2% prior to now 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant, X, and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.