Starbucks has struggled to maintain tempo with the general markets. Will new administration assist? The Each day Breakdown dives in.

Earlier than we dive in, let’s ensure you’re set to obtain The Each day Breakdown every morning. To maintain getting our every day insights, all you could do is log in to your eToro account.

Friday’s TLDR

SBUX has an MVP CEO

However the turnaround will take time

And expectations are climbing

Deep Dive

Starbucks has been battered from its highs, down 30% from its 2021 peak. General, the S&P 500 has executed fairly nicely in that span, rising about 35%. So whereas shares of Starbucks could possibly be doing an entire lot worse, they’ve clearly underperformed the general market. Will that change going ahead?

New Administration

It was clear that Starbucks was struggling and that its management staff was flailing, so in September, Starbucks lured away Chipotle CEO Brian Niccol to run the corporate. Niccol price a fairly penny to usher in — no pun meant — however shareholders had been keen to take the chance.

That’s primarily based on his resume, which features a profitable run at Taco Bell, then jumpstarting Chipotle after a string of food-related sicknesses tarnished its model. Below Niccol’s management from March 2018 to August 2024, Chipotle’s income doubled, earnings elevated seven-fold, and the inventory climbed greater than 800%.

The hope right here is that Niccol may also help flip round Starbucks. The truth is that it’s going to take greater than 1 / 4 or two to repair.

Progress Expectations

On the subject of the basics, there’s excellent news and dangerous information.

The dangerous information is, analysts count on earnings to fall 26% this fiscal 12 months — ouch. The excellent news is, Starbucks’ fiscal 12 months ends in September. The opposite excellent news is that consensus estimates name for 20% earnings development in every of the subsequent two years, and practically 20% development within the third 12 months.

If Niccol & Co. obtain that feat, the inventory might very nicely be undervalued at right now’s costs.

Dangers

Bear in mind once we did the Elementary Evaluation Boot Camp?

Sadly, Starbucks isn’t precisely low cost at present ranges. Not less than, that’s primarily based on its ahead price-to-earnings ratio (or the fP/E), which takes the inventory worth (P) and divides it by anticipated earnings (E).

Consider it like this: Even when SBUX inventory worth stays flat, a decline in earnings makes the inventory costlier from a valuation perspective.

That is the place buyers need to determine if the inventory is true for them.

The Backside Line

The danger/reward proposition is obvious.

On the one hand, you have got a significant potential turnaround within the works beneath confirmed management. If it really works, shares of Starbucks may have notable upside from present ranges. Nevertheless, if the turnaround takes longer than anticipated or doesn’t materialize to the diploma that’s anticipated, then the inventory’s returns could also be disappointing.

It might be much less dangerous to attend and see if the turnaround at Starbucks is taking maintain. Traders who wait threat having the inventory rise in anticipation of this improvement, then are compelled to purchase in at larger costs (albeit with extra potential stability within the fundamentals). On the flip facet, those that purchase in early stand to learn probably the most if the turnaround succeeds. However in addition they stand to threat extra if the inventory comes beneath stress.

Need to obtain these insights straight to your inbox?

Join right here

The Setup — Starbucks

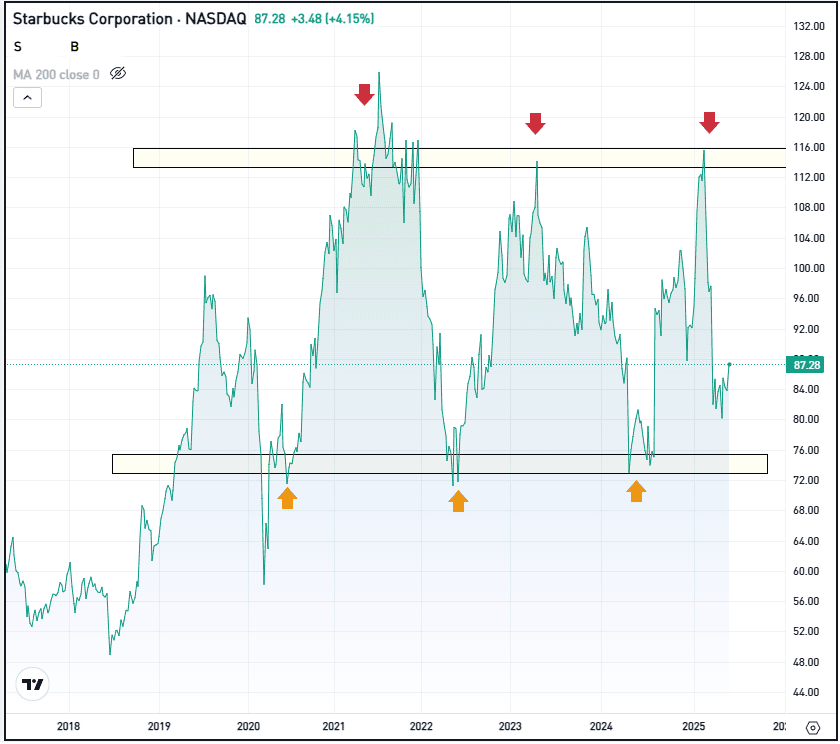

Starbucks shares popped from the mid-$70s in August on information of Niccol’s rent and rallied all the best way to $117.46 in March 2025 — lower than 10% from all-time highs. Nevertheless, the pullback has been swift, sending shares again down into the $70s earlier than the newest bounce.

For a number of years now, shares have been caught between roughly $75 and $115:

Going ahead, buyers need to see SBUX discover assist within the $70s and ultimately rebound larger. If assist fails to carry, decrease costs could possibly be in retailer, probably down into the mid-$60s. Nevertheless, if the rebound beneficial properties steam, the $115 vary — which SBUX hit just a few months in the past — could possibly be again in play.

Choices

Traders who consider shares will transfer larger over time might contemplate taking part with calls or name spreads and may use long-dated choices to take part. If speculating on a long-term rise, buyers would possibly think about using enough time till expiration.

For buyers who would fairly speculate on the inventory decline or want to hedge a protracted place, they might use places or put spreads.

To study extra about choices, contemplate visiting the eToro Academy.

Disclaimer:

Please observe that on account of market volatility, a number of the costs might have already been reached and situations performed out.