Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin has reclaimed the $90,000 mark, fueling renewed optimism throughout the crypto market. With sentiment shifting and bullish calls returning, many traders are as soon as once more eyeing a transfer towards six figures. Nonetheless, not all the pieces is because it appears beneath the floor. Regardless of the spectacular worth surge, dangers stay, notably as world tensions between the US and China escalate. The continuing commerce warfare and geopolitical friction are injecting volatility into markets, making a fragile backdrop for danger property like Bitcoin.

Associated Studying

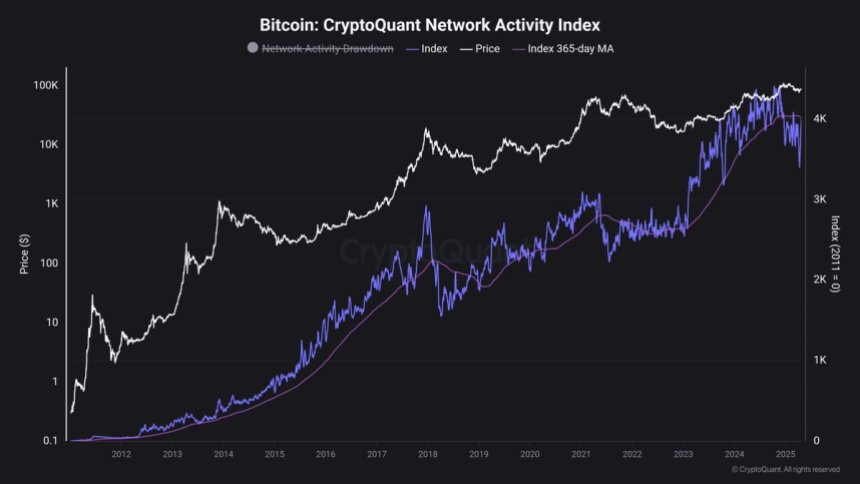

Prime analyst Maartunn shared a stark view of the present state of the Bitcoin community, revealing on-chain metrics that paint a special image. Based on his evaluation, the most recent transfer greater is primarily pushed by leverage and derivatives fairly than sturdy natural demand. He famous that the Bitcoin community is, in his phrases, “a ghost city,” with little or no new exercise or seen inflows from actual customers.

This disconnect between worth and on-chain fundamentals means that the present rally might lack sustainability. As such, traders ought to strategy the subsequent section of Bitcoin’s worth motion with warning, particularly if macroeconomic circumstances worsen or spinoff positions start to unwind.

Bitcoin Faces Resistance: On-Chain Exercise Lags Behind

Bitcoin is now going through important resistance as bulls try and reclaim the $95,000 degree, a zone that would outline short-term momentum. The latest breakout above the $88,600 resistance marked a key shift in market sentiment, with bulls taking management and pushing worth motion into a brand new vary. Nonetheless, to take care of this momentum, sustained demand can be important. Analysts warn {that a} wholesome retracement might happen earlier than the subsequent leg up, particularly contemplating present market circumstances.

Volatility and uncertainty proceed to dominate the panorama, with worry nonetheless lingering regardless of the latest rally. A lot of this warning stems from ongoing world tensions and the unstable macro setting that has unfolded since US President Donald Trump’s re-election in November 2024. With tariffs rising and commerce negotiations with China rising more and more tense, traders stay hesitant to commit absolutely to danger property.

Prime analyst Maartunn shared a sobering on-chain evaluation on X, highlighting a disconnect between Bitcoin’s worth motion and community exercise. Based on his findings, the latest surge is basically pushed by ETF flows and rising open curiosity within the derivatives market—components that always precede a reversal fairly than a sustainable rally. Maartunn describes the present state of the Bitcoin community as a “ghost-town,” noting an absence of latest seen on-chain demand.

This divergence between worth and community fundamentals raises questions concerning the sustainability of the present transfer. For Bitcoin to push convincingly previous $95K and arrange a run towards $100K, stronger spot demand and an uptick in actual person exercise will seemingly be obligatory. Till then, merchants ought to stay cautious and watch key help ranges carefully.

Associated Studying

Value Motion Particulars: $95K In Sight

Bitcoin is buying and selling at $93,600 after a number of days of bullish worth motion that noticed it reclaim key resistance ranges. The worth has now entered a consolidation section across the $93K degree, as bulls put together for a possible breakout towards $95K. A sustained transfer above that mark would open the door for a push towards the extremely anticipated $100K milestone, signaling renewed energy throughout the crypto market.

Nonetheless, the trail ahead stays unsure. Whereas short-term sentiment seems optimistic, Bitcoin should maintain above the $90K help degree to take care of bullish construction. A failure to take action might set off a drop again towards the 200-day transferring common close to $88K—a degree that has served as a key pivot for market construction over the previous months.

Associated Studying

This zone is being carefully watched by each merchants and long-term holders, as a breakdown beneath $90K would seemingly undermine the present restoration momentum. As consolidation continues, the subsequent few classes can be important in figuring out whether or not BTC has sufficient energy to interrupt greater or if a short-term correction is in retailer. For now, all eyes are on $95K as the subsequent hurdle in Bitcoin’s push to reclaim market dominance.

Featured picture from Dall-E, chart from TradingView