Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin is buying and selling above the $90,000 mark and displaying indicators of renewed energy, at the same time as world tensions and macroeconomic uncertainty proceed to weigh on investor sentiment. After weeks of unstable swings and bearish stress, the main cryptocurrency seems to be stabilizing, and a few analysts consider this might mark the start of a broader rally within the coming months.

Associated Studying

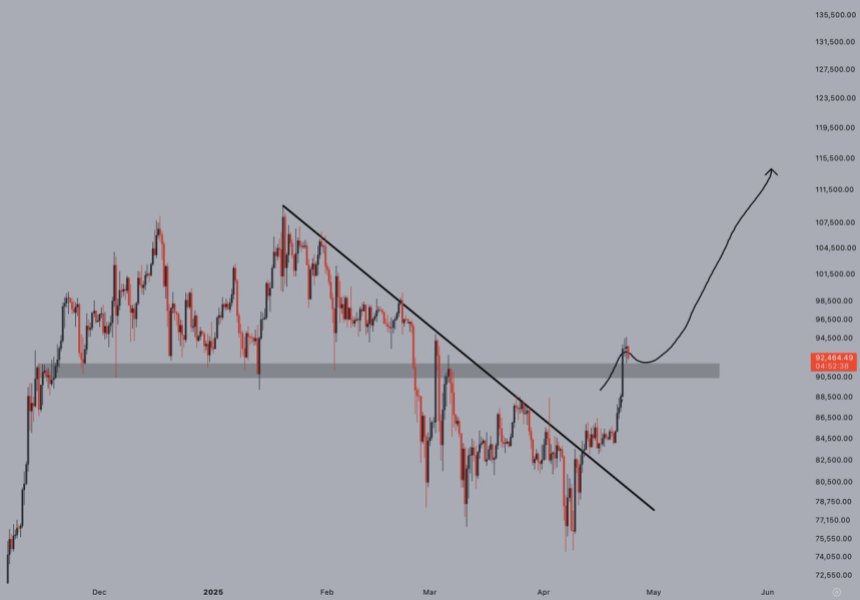

Prime crypto analyst Jelle shared insights accompanied by a worth chart, highlighting a key technical improvement: Bitcoin has reclaimed the vary lows and is holding them to this point. This sort of worth motion sometimes alerts wholesome consolidation and rising purchaser confidence.

Regardless of ongoing commerce battle considerations and rate of interest uncertainty, Bitcoin’s resilience is providing hope to buyers. Holding the present vary may set the stage for a push towards new all-time highs if momentum continues to construct. Whereas warning stays attributable to exterior dangers, many see the present setup as a probably bullish inflection level that might form the following main leg up within the crypto market.

Bitcoin Reclaims Vary Lows as Sentiment Turns Bullish

Bitcoin is now buying and selling at essential ranges after a pointy market impulse shifted sentiment practically in a single day. For months, BTC has been caught in a downtrend that started in January, irritating bulls and resulting in requires deeper corrections. However with the latest surge pushing BTC above $90,000, many analysts consider that this pattern could have lastly reversed.

Nevertheless, warning nonetheless dominates the broader panorama. International uncertainty, pushed by escalating commerce tensions between the US and China and unpredictable macroeconomic alerts, continues to weigh on investor confidence. A single adverse improvement—comparable to hawkish central financial institution coverage or geopolitical instability—may shake the market again into risk-off mode.

Nonetheless, optimism is returning, significantly amongst technical analysts. Jelle shared an replace highlighting that Bitcoin has reclaimed the vary lows and is holding them. “Precisely what you wanna see if actually bullish,” he famous, emphasizing {that a} shallow pullback adopted by energy sometimes precedes additional continuation to the upside.

This situation would counsel that the time for simple entries is behind us. If this momentum holds, Bitcoin might be on observe to interrupt new all-time highs prior to many anticipate. The breakout has reignited hopes for a significant bull run, however the subsequent few days will likely be key in confirming whether or not this transfer is sustainable or simply one other short-lived rally.

Associated Studying

BTC Holds Above $90K After Reclaiming Key Transferring Averages

Bitcoin is buying and selling at $92,500 after a robust transfer above the psychological $90K degree, confirming bullish momentum within the quick time period. This breakout additionally marked a decisive shut above the 4-hour 200 MA and EMA, each of which had acted as stiff resistance since January. Reclaiming these technical ranges alerts a possible shift in pattern after months of promoting stress and sideways motion.

With bulls now firmly in management, the main target shifts to the $100K mark—an space that not solely carries psychological weight but additionally serves as the following key resistance within the rally. A push above this degree would seemingly appeal to new patrons and make sure a broader breakout, setting the stage for a possible all-time excessive run.

Associated Studying

Nevertheless, warning continues to be warranted. If Bitcoin fails to take care of momentum and drops beneath $88,500, it may set off a consolidation part or perhaps a bigger correction. The $88.5K zone, now a key help, should maintain to protect the bullish construction. As Bitcoin hovers close to these essential ranges, the following transfer will seemingly outline short-term route for each BTC and the broader crypto market.

Featured picture from Dall-E, chart from TradingView