Bitcoin has produced a range-bound motion just lately, with costs oscillating between $83,000 and 86,000. Apparently, well-liked crypto analyst Burak Kesmeci has recognized the vital worth ranges for any short-term motion.

Help At 82,800, Resistance At 92,000 – However The place Is Bitcoin Headed?

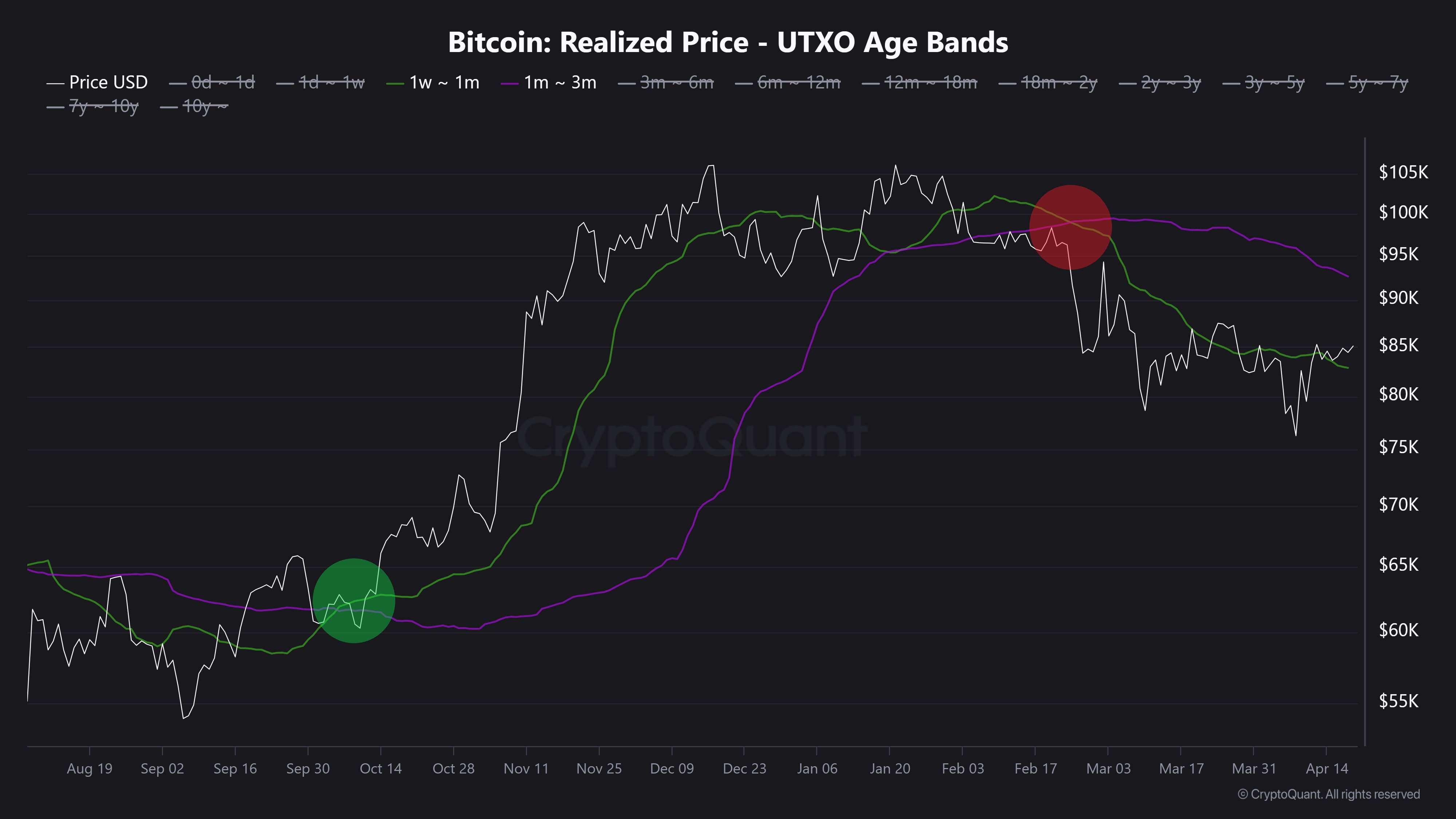

In a brand new put up on X, Kesmeci shared an fascinating on-chain evaluation of the Bitcoin market. Utilizing the short-term investor price foundation, the analyst recognized two key worth ranges that might show important to Bitcoin’s subsequent main transfer. Firstly, Burak Kesmeci focuses on the common price costs of recent merchants over the previous 1-4 weeks, that are probably essentially the most reactive to cost adjustments. The realized worth for these merchants at present stands at $82,800, forming a near-term assist that signifies many current patrons are nonetheless in revenue and will defend this stage as a psychological flooring.

In the meantime, Kesmeci additionally highlights the $92,000 worth stage, which marks the common price foundation for BTC holders for 1-3 months. This worth level has emerged as an vital resistance zone, as traders are more likely to exit the market as soon as they break even. Moreover, the $92,000 worth stage can also be marked by a confluence with varied technical indicators.

The interaction between these two ranges is important. Traditionally, short-term bullish tendencies in BTC have a tendency to start when the price foundation of newer traders, 1–4 weeks, crosses above that of the 1–3 BTC holders. This shift alerts elevated confidence and willingness to purchase at increased ranges, which frequently fuels broader rallies.

Nevertheless, that dynamic stays to play out within the present market. As of now, Bitcoin is buying and selling round 85,000, positioning it above its assist on the 1–4 week common of $82,800 however nonetheless under the 1–3 month resistance of $92,000. Moreover, each price foundation ranges have been declining over the previous two months, reflecting hesitation or a scarcity of aggressive shopping for from new entrants.Notably, Kesmeci states that BTC should surge above $92,000 to substantiate a robust bullish momentum for a worth reversal.

Bitcoin ETFs Offload 1,725 BTC

In different information, Ali Martinez reviews that the Bitcoin ETFs have suffered withdrawals of 1,725 Bitcoin, valued at $146.92 million, over the previous week. This growth illustrates a excessive stage of detrimental sentiment amongst institutional traders, including to market uncertainty across the BTC market.

In the meantime, Bitcoin trades at $85,249 following a worth change of 0.89% prior to now day. The premier cryptocurrency additionally displays a 0.58% loss on the weekly chart and a 1.06% achieve on a month-to-month chart.

Function picture from Adobe Inventory, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.