Information exhibits the cryptocurrency derivatives sector has seen a mass liquidation occasion up to now day as Bitcoin and different belongings have crashed.

Crypto Market Has Seen A Lengthy Squeeze In The Final 24 Hours

Based on knowledge from CoinGlass, a considerable amount of contracts have been liquidated through the previous day. A place is claimed to be “liquidated” when its platform decides to forcibly shut it down. The change does this when the holder has amassed losses exceeding a sure threshold.

There are two elements that may increase the possibilities of liquidation. The primary one is volatility. A extremely unstable asset can find yourself fluctuating each methods a lot that it may be arduous to guess on a path.

Volatility isn’t within the person’s hand, however the second issue, leverage, is. “Leverage” refers to a mortgage quantity that any investor can decide to take up towards their preliminary collateral. Leverage can imply that the earnings earned by the holder turn out to be multitudes extra, however the identical additionally applies to the losses, so the chance of liquidation naturally rises.

Within the cryptocurrency market, each of those elements are typically at all times current, as cash usually show wild swings inside brief home windows and there’s an abundance of speculators prepared to guess excessive.

The results of these situations is that mass liquidation occasions, popularly known as squeezes, happen on the common. One such occasion has taken place within the final 24 hours, because the beneath desk exhibits.

Appears to be like just like the liquidations have closely tended in direction of lengthy contracts on this interval | Supply: CoinGlass

As is seen, cryptocurrency-related liquidations have totaled as much as a whopping $904 million through the previous day. Out of those, $811 million of the flush, representing virtually 90% of the overall, concerned the lengthy contract holders alone.

The explanation behind the liquidations leaning so closely in direction of the merchants betting on a bullish final result naturally lies in the truth that Bitcoin and different belongings have witnessed a crash on this window.

Here’s a heatmap that exhibits how the liquidations have seemed when divided by image:

The distribution of the liquidations by image | Supply: CoinGlass

As displayed above, Bitcoin has contributed to the biggest share of the liquidations at $261 million. Ethereum (ETH) has come second at $113 million and Solana (SOL) third at $39 million.

XRP (XRP) is bigger in market cap than SOL, however has nonetheless carried out worse on this metric, probably due to the truth that the latter has seen a bigger value drawdown.

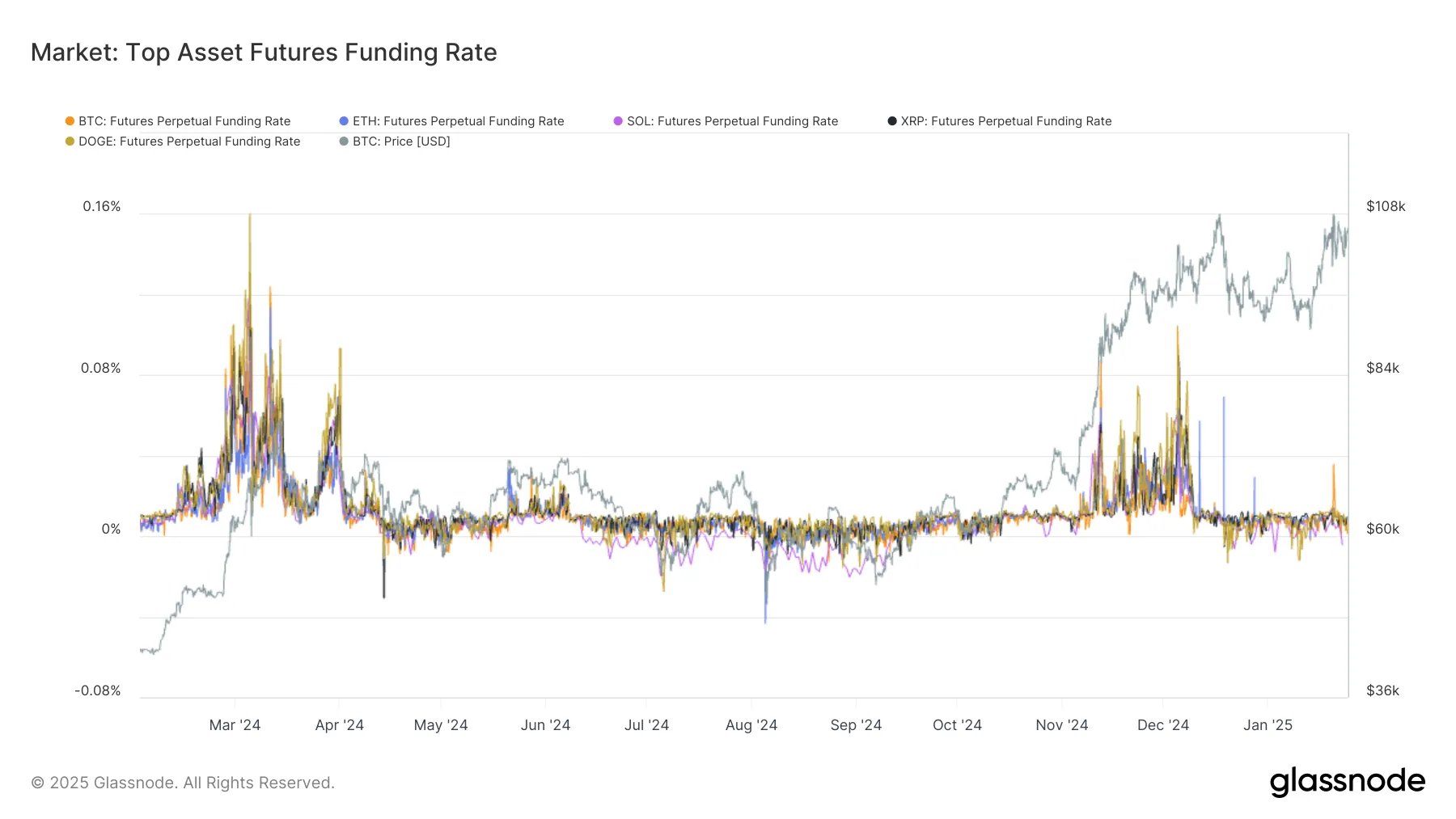

Curiously, whereas a protracted squeeze has occurred within the sector, the exchanges have really not been too long-heavy by way of positions lately, because the analytics agency Glassnode has identified in an X publish.

The pattern within the futures funding charge for the highest 5 cryptocurrencies | Supply: Glassnode on X

“The hourly funding charges for the highest 5 belongings available in the market ( $BTC, $ETH, $SOL, $XRP, $DOGE) present the urge for food for lengthy positions has not returned to the degrees seen within the November to early December rally,” notes Glassnode.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $100,400, down over 4% within the final seven days.

The worth of the coin appears to have plunged over the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CoinGlass.com, Glassnode.com, chart from TradingView.com